Analysis of Export Market Trends for Luggage and Bags: Category, Customs Code, and Regional Comparison

![]()

In recent years, the global luggage and bag market has witnessed a trend

towards diversification and personalization. As a leading producer and exporter

of luggage and bags, China holds a significant position in this development. By

carefully analyzing customs data, we can understand the export trends of luggage

and bag products, which offers valuable references for relevant enterprises when

formulating their strategies.

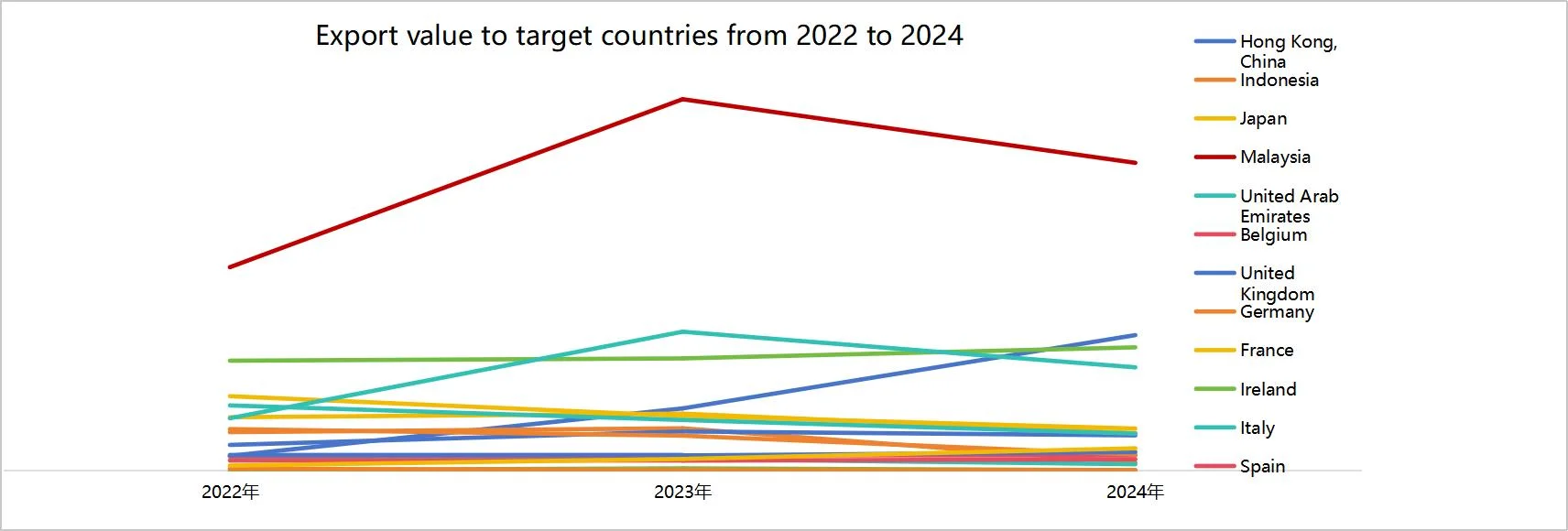

1. Luggage and travel goods, with outer surface of leather or reconstituted

leather (42021190)

These products have shown a certain trend of fluctuation from 2022 to 2024,

with the monthly average export gradually declining.

The trade export partners of these products are Malaysia, the United States,

and Hong Kong. Among them, the export value to Malaysia has always been

significantly than that to other countries, showing a growth trend from 2022 to

2023, but it has declined somewhat in 2024. Other major trading export partners

are the United States and Hong Kong, which have relatively slow growth.

In terms of exports, Guangdong has always been far of Zhejiang, and the

average price of these products has also been higher than Zhejiang. But in

recent years, this trend has declined.

The export has gradually declined, and the decrease in export volume and the

increase in unit have reflected the intensification of market competition and

consumers’ higher pursuit of product quality, which has prompted enterprises to

increase R&D investment, improve product design and process level, and meet

demand.

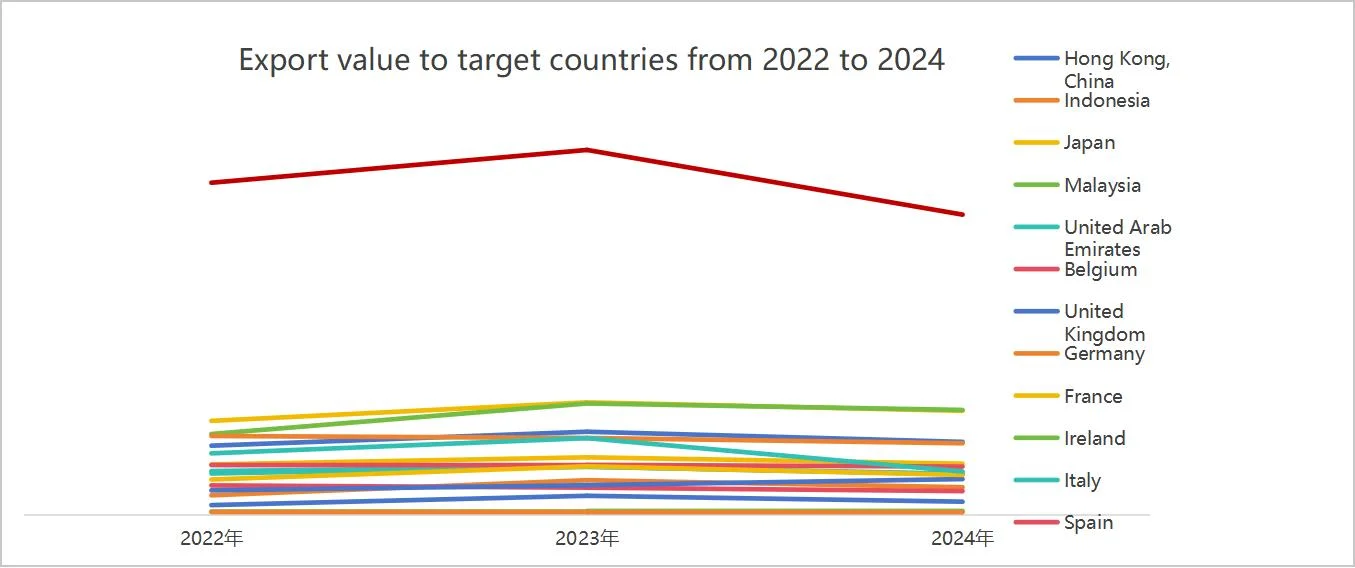

2. Luggage, handbags, briefcases, schoolbags and similar containers with

plastic or textile material as the surface (4201290)

From 2022 to 2024, the monthly average export volume of this product far

exceeded other types of products. In 023, the average export value increased

significantly, while in 2024, it decreased somewhat. This product enjoys great

popularity in the US market, with its export value far outstripping that of

other trading partners.

The export volumes between Guangdong and Zhejiang provinces have been

relatively close, yet Guangdong has consistently maintained the lead. However,

in 2024, Zhejiang's exports exceeded those of Guangdong. In terms of average

price, there is no particularly obvious fluctuation.

This type of product has a strong market demand, which may be attributed to

the advantages of plastic and textile materials because of light weight,

durability, and low cost. These advantages enable it to occupy an important

position in the luggage and bag market. However, under the influence of factors

like the intensifying market competition, a market decline has occurred.

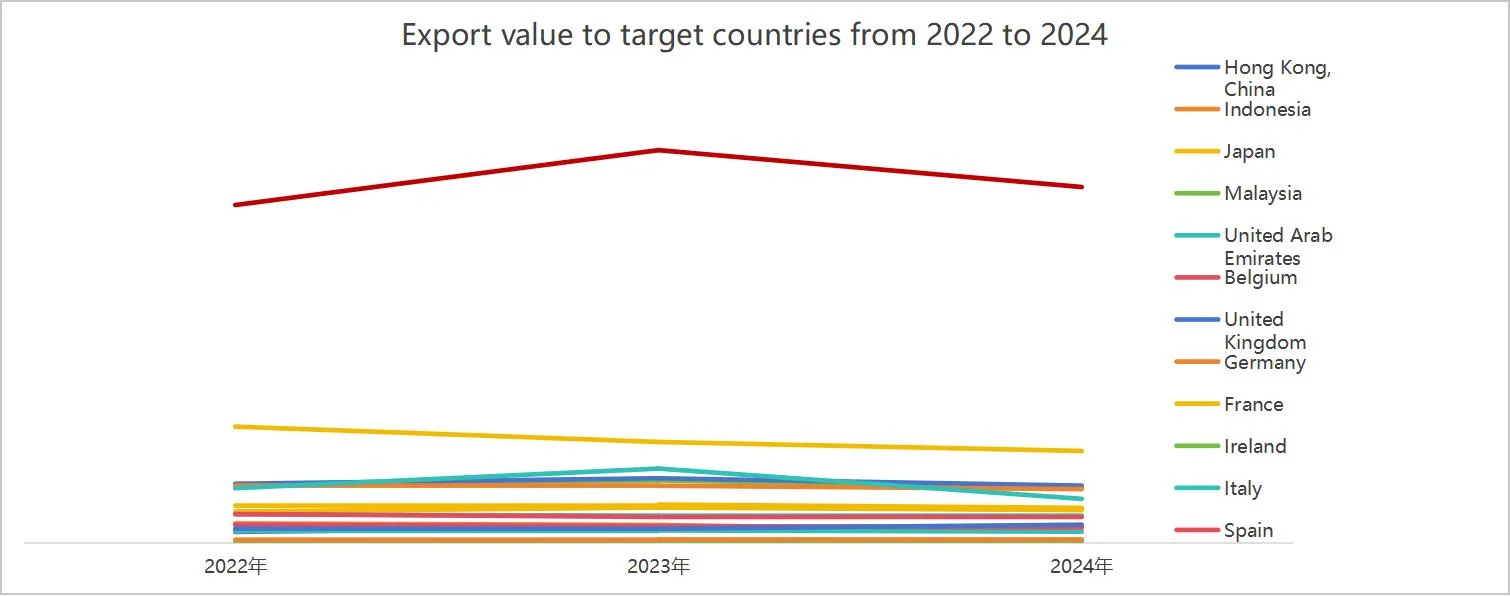

3. Other similar containers with plastic sheet or textile material as the

surface (42029200)

The monthly average export value of this product has demonstrated a

relatively stable growth trend. The United States serves as the primary export

partner for this product. However, after hitting its peak value in 2023, the

export value to the US has shown a downward tendency. Meanwhile, the export

value to Japan has been steadily on the rise.

In terms of export value, Guangdong Province takes the lead. Nevertheless,

its average price is higher than that of Zhejiang Province. In contrast, both

the average price and export volume of Zhejiang Province remain relatively

stable. This trend shows that the category has strong competitiveness in the

market and stable consumer demand.

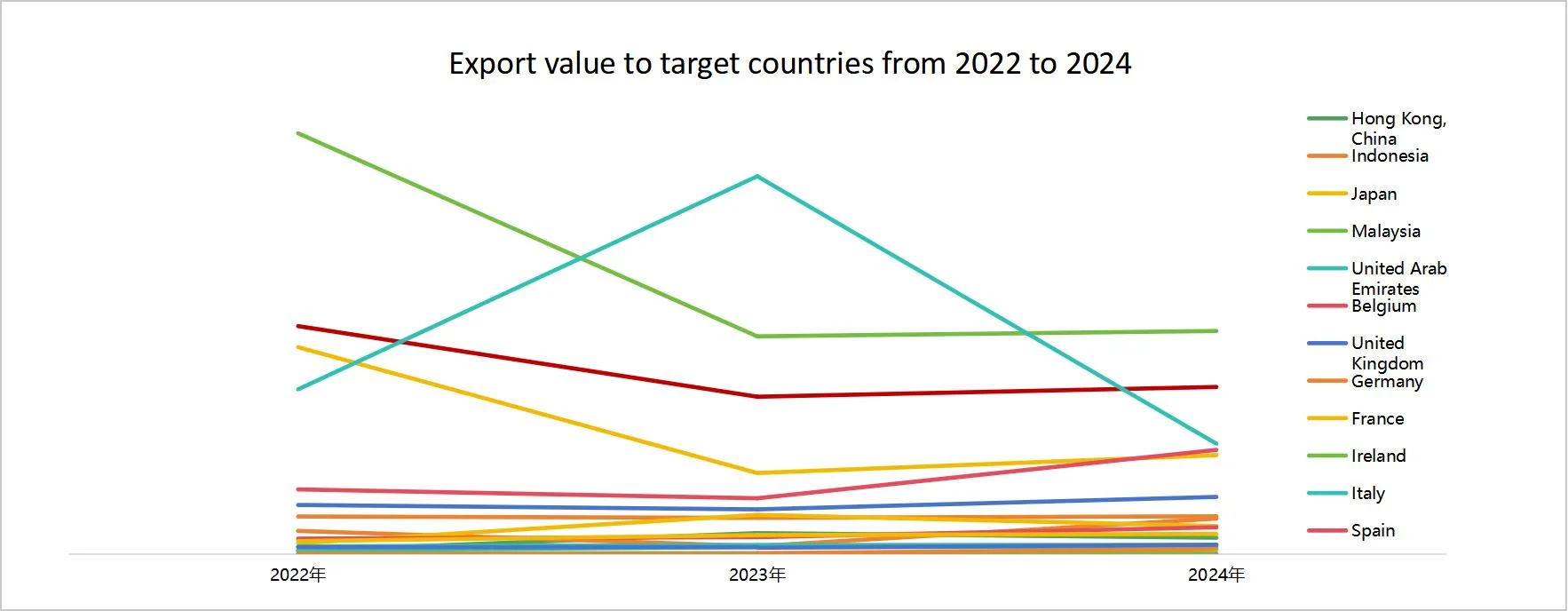

4. Luggage and bags with other materials as the surface (42021900)

From 2022 to 2024, the export value of this product decreased year by year.

In 2022, the monthly average export value was relatively high.

When it comes to export trading partners, there has been significant

volatility. For instance, the export value to Belgium has been growing steadily.

Malaysia, which was the most crucial trading partner in 2023, has seen a gradual

decline. In Australia, the export value soared in 2023 but then dropped

rapidly.

Guangdong Province has a greater export volume and higher export value

compared to Zhejiang Province. Still, in Guangdong Province, both the average

price and the export value have been dropping rapidly. This trend suggests that

this product category might encounter some challenges in the marketplace. Issues

like a lack of product innovation, mounting cost pressures, and shifts in

consumer demand have caused its market share to gradually dwindle. As a result,

companies must step up product innovation and expand their market reach to deal

with the pressures emerging from market competition.

5. Conclusion

To sum up, the luggage and bag products from China display robust

competitiveness and promising market outlooks in the global market. Every

product category, owing to its distinct features and benefits, caters to the

diverse demands of different consumers.

In the realm of export trade, China's commercial interactions with various

nations are growing ever closer. At the same time, it is confronted with a

multitude of challenges and opportunities. Zhejiang and Guangdong, the two

prominent export – focused provinces, each possess their own unique traits,

offering substantial support for the development of the industry.

Looking ahead, the Chinese luggage and bag industry should further intensify

innovation, enhance product quality, and broaden its market reach to realize

more sustainable development.

.png)